🆕 How Market-Making, Hedging, and Cross-Exchange Rebalancing Actually Work

Market making your own crypto exchange? Learn how hedging bots balance risk and what happens when users trade against your liquidity

When considering launching your own cryptocurrency exchange, a natural question arises: how profitable can it really be? What is the average income that can be made from running a crypto business?

Crypto exchanges primarily generate revenue through trading fees, but overall profitability hinges on a mix of strategic and operational factors. These include:

For simplicity, this article assumes the exchange already has an active user base. While acquiring and retaining users remains one of the toughest challenges — especially in a crowded, highly competitive, and often skeptical crypto landscape market conditions are evolving.

Bitcoin's role as the first globally recognized, borderless digital asset with real, transactable value continues to drive broader crypto adoption. This ongoing expansion opens new opportunities for exchanges to tap into underserved markets and build profitable, localized trading platforms. Particularly in regions where traditional fintech infrastructure is still developing, crypto exchanges can serve as crucial gateways to financial services.

Below are the hard numbers 👇

Every exchange is different. Below are just a few bold examples illustrating the potential revenues based on different scenarios based on the initial user base size, and high vs. low fee structures:

💰 Projected Annual Revenue: $127,158

💰 Projected Annual Revenue: $194,794

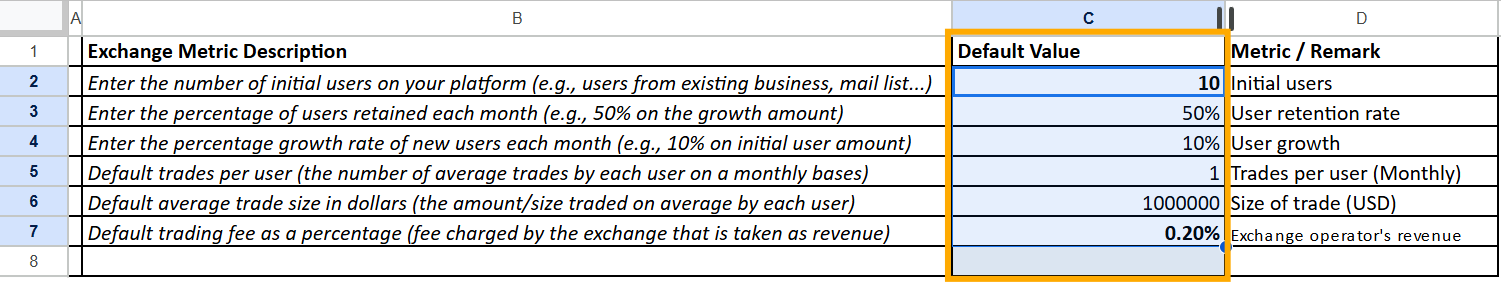

Try it for yourself by inputting the users, fees and projections to see how your crypto business model would work:

What more control? Try using this spreadsheet.

Effective marketing strategies play a crucial role in driving user growth, retention, and overall exchange profitability. Tactics such as email campaigns, SMS alerts, targeted promotions, and incentives can significantly boost user engagement — encouraging higher trading volumes and increased trading frequency (x4 a month in the below scenario). In turn, these efforts may directly contribute to stronger growth and improved user retention over time.

💰 Annual Revenue: $402,340

While this approach may require expertise and upfront investment in marketing, the potential return is clear — strategic, well-executed campaigns that drive user activity can significantly enhance long-term profitability.

Typically suitable for very large exchanges, a low-fee model (around 0.10%) relies on scale, leveraging a large user base for profitability. Smaller exchanges might also adopt this approach if supplemented by revenue streams from off-exchange activities such as physical OTC trades or private arrangements.

💰 Annual Revenue: $482,648

Exchanges with substantial user bases (e.g., 1 million users) enjoy massive profitability advantages through economies of scale.

Annual Revenue: $2,413,244

For established businesses with exclusive high-net-worth customerbase that are loyal customers (View the VIP exchange spreadsheet here.), this exclusive client type may present a highly profitable niche. These users typically generate substantial transaction volumes, even with minimal trade frequency:

💰 First Year Estimated Revenue: $318,342.53

Such a model scales exceptionally well, reaching revenues of $890,039.98 in year two and $1,916,726.45 in year three. If acquisition of new clients consistently increase at a rate a modest rate of 10% with 50% of those new clients staying to trade long term, than in theory the revenue can exponentially increase as illustrated above.

💡 Tip:

Future revenue projections depend heavily on your User Retention Rate, which is calculated based on the User Growth Rate, and both are ultimately influenced by your Initial User Count. Even small changes to these variables can have a significant compounding effect on long-term profitability — so be sure to adjust them carefully when modeling your exchange’s potential.

Make a copy of the spreadsheet, change the values and find out the profitablity of your crypto business today!

***

DISCLAIMER:

Figures presented are illustrative estimates and do not guarantee actual results. Always consult financial professionals before making business decisions. The spreadsheet is intended for general informational purposes only. Be sure to adjust the assumptions and formulas to reflect your specific business model, and account for operational costs and other overheads when forecasting profitability.

***

Looking for business software that works with cryptocurrencies?

Discover the award-winning white-label exchange solution here.