KYC (“Know Your Customer”) is the process exchanges use to verify a user’s identity to meet AML/CTF requirements.

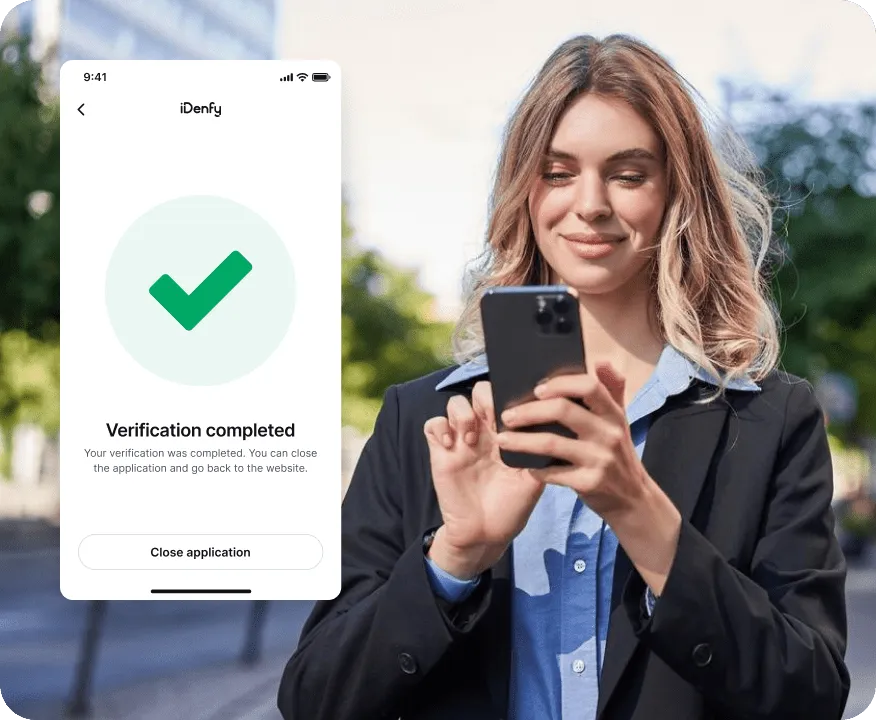

It typically collects basic details (name, date of birth, nationality/address) and verifies them with a government-issued ID and a quick selfie/liveness check.

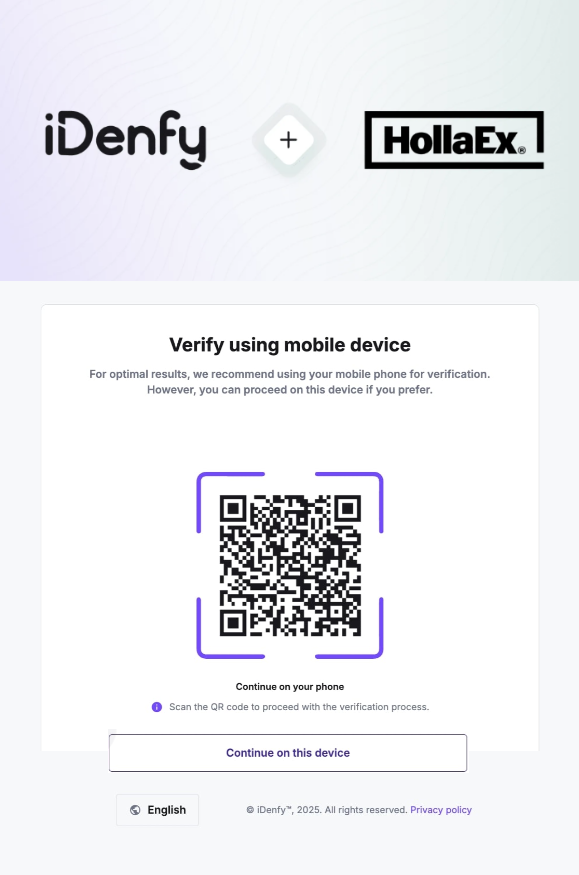

HollaEx® ships with a built-in KYC module and plug-in support for leading providers. Operators can enable KYC in a few clicks, collect required fields, and review/approve cases from the back-office—no custom development needed. Most plans include iDenfy out of the box, and we also support providers such as Sumsub, with straightforward integrations for others.

What the built-in module provides

Configurable data capture (name, DOB, nationality/address, document type/number). Secure file uploads for supporting documents. Review queue with approve/reject and notes. Tiers/rules by region, plus exports and audit trails.

Using third-party KYC providers

Toggle a provider (e.g., iDenfy, Sumsub & others) and map required fields. Users complete ID scan + selfie/liveness in the provider flow. Results sync back to your dashboard via API/webhooks.

See the KYC plug-ins page for details on supported vendors and plan availability.

Crypto exchanges, OTC, brokers, and fintech teams that want compliant, conversion-friendly onboarding. Start with HollaEx® native KYC or connect your chosen provider.

Extremely low integration overhead, scalable per-user-check cost & you are not locked into any KYC vendor's system.

If you got something that needs extreme localization, let us know and we can integrate lesser known KYC providers and include extra verification step so that you can match your compliance needs.